As a Pet Sitter in Australia, you need to be aware of any tax obligations you might have. The Australian Taxation Office has a web page listing allowable expenses you can claim depending upon what industry you are in, but they haven’t included specific deductions for the Pet Sitting industry.

While this is article is not taxation advice, we have put together a list of expenses that you may possibly be able to claim part of. To be sure, we recommend you book an appointment with a Taxation Accountant.

Examples of Claimable Expenses

1. “Tools” on the Job

If you use items exclusively for pet sitting you may be able to deduct things like a waterproof pet hammock to protect the back seat of your car, grooming equipment, dog and cat treats, squeaky toys, leashes, kitty litter and the roll of plastic dog waste bags you use to play and care for your clients.

2. Self-Education Expenses

PetCloud’s Accredited Pet Sitting Course is a great example of what the ATO calls a self-education expense which you may be eligible to claim a tax deduction for. You may also be able to take a deduction for the cost of other seminars plus travel and hotel room expenses. Your subscriptions to any work-related magazines or websites may also be deductible.

3. Computer & Printer

Think about what you use to communicate with clients. You may use a mobile phone, a laptop, or tablet to take bookings, research, learn or share photos and videos with pet owners missing their furbaby. Your Computer & Printer may possibly attract a partial tax deduction as an allowable expenses.

4. Advertising

Your custom business cards and PetCloud online listing is almost like a marketing brochure and gives you a chance to tell potential customers what services you offer, show real life photos and detail your rates. Your PetCloud listing may be an allowable expense. Again, speak to your Accountant.

5. Sharing Economy Platform Commission

“Remember, if you offer your services through a sharing economy platform, they generally take a 20% fee or a commission out of the price you charge your customer for the service. That fee or commission is tax deductible.”

6. Phone & Internet

The cost of a smartphone used for business and wifi to access the internet is an allowable expense, however if there is personal use then only a proportion of the costs relating to your business can be claimed.

7. Clothing on the Job

Rain coats, umbrellas, gum boots, hats, sunglasses, suncream, and non-slip footwear are examples of items you might be able to claim if you work outdoors with day care, dog walking, or dog training.

If you have a branded Tshirt that you wear while you walk dogs for example, then you may be able to claim for this cost.

You can’t claim the cost of wearing your usual / normal clothing and unfortunately the cost of washing your clothes at home is not either.

8. Car related expenses

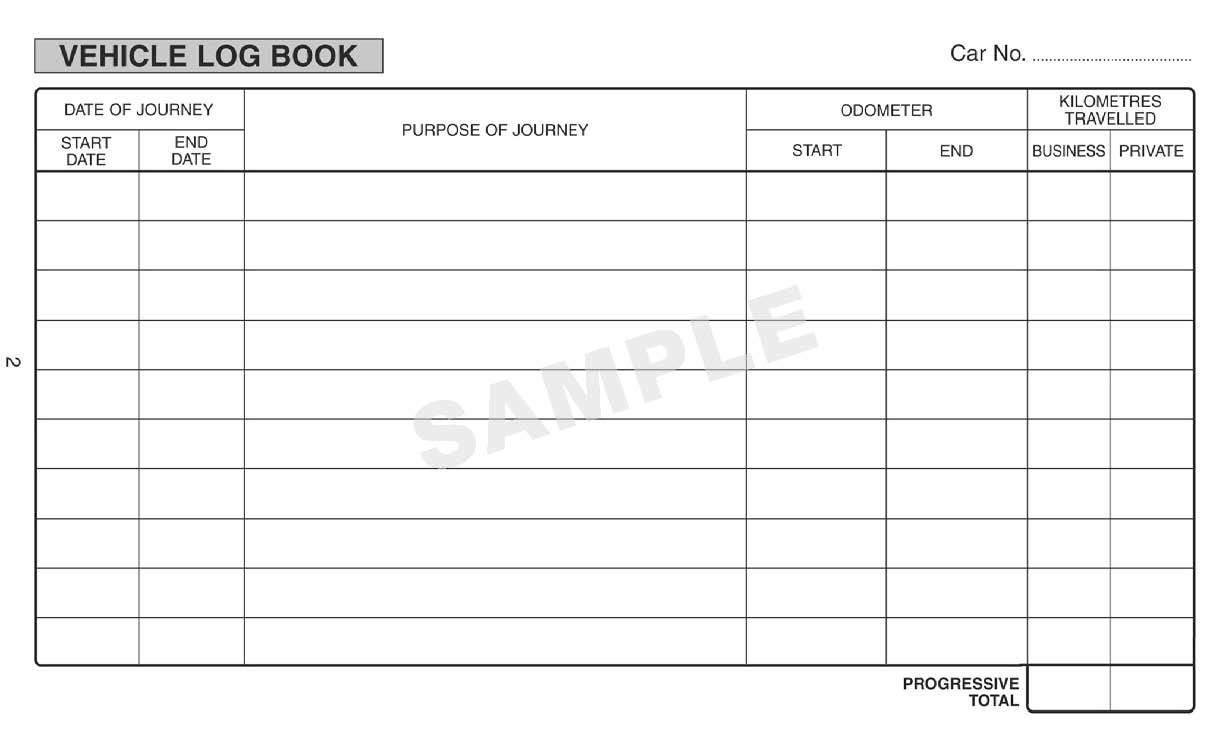

Offering a pick up and drop off service for pets may be part of your services you offer as a pet sitter. You may possibly claim a deduction for parking fees and tolls you incur on work-related trips. An app called Drivers Note does automated trip logging instead of keeping paper logs.

You can also draw up a paper log book or buy one from a Newsagent to keep a note of the mileage you travel. Record your kilometres to and from your destination, dates, trip purpose, and keep your petrol receipts!

8. Use of your Home

There are rules that will allow you to claim an amount for the running costs of being a self employed pet sitter from your home as a portion of your household bills such as gas, water, electricity, mowing the lawn, or rent. Make sure you have an idea of your household running costs to discuss with your accountant at tax return time as they will help you work out how much you might be able to claim against your taxable income.

9. Treats, Pet Food and Toys

You need to keep pets enriched, fed, and watered, so keep your receipts for any of these costs. This way you may be able to claim a tax deduction.

10. Accounting & Bookkeeping

Keeping good business records will save you stress, time, and hassle in the long run. It will also help you to avoid forgetting out entitlements you may be eligible to claim. The more organised you are, the less fees you’ll also be charged by your Accountant. Using a cloud based accounting software such as Xero, Quickbooks or Wave will make life easier, so if you do choose to sign up the cost of the monthly subscription may be tax deductible. Then, if you choose to use an accountant to complete your self assessment tax return, again their fees will be an allowable expense.

11. Bank Charges

It is advisable to open a business bank account and be sure to record your business and personal expenditure separately. The bank charges you pay on your business bank account may be treated as an expense you might be able to claim as a tax deduction.

12. Charity

If you donate to your local animal-welfare charity, you may be able to claim a tax deduction.

Renewed Police Checks

13. Renewed Police checks.

Find local Vets, store your Pet’s Health, etc, download PetCloud today.

Download IOS: https://apple.co/2PifzXs Android: https://bit.ly/3aFeK2m